The Emerging Resale Market: Recommerce and Resale Industry Stats

Online and offline resale and recommerce have outperformed the overall retail industry for the last eight years. As the fashion world moves toward a more sustainable model and the spending preferences of younger consumers force brands to be more accountable, thrifting is making the transition from being something a few outliers did to save money to being positioned as, wait for it… the next big fashion trend.

Yeah. There are some interesting things going on here. So, strap in.

The Verticals We’re Covering

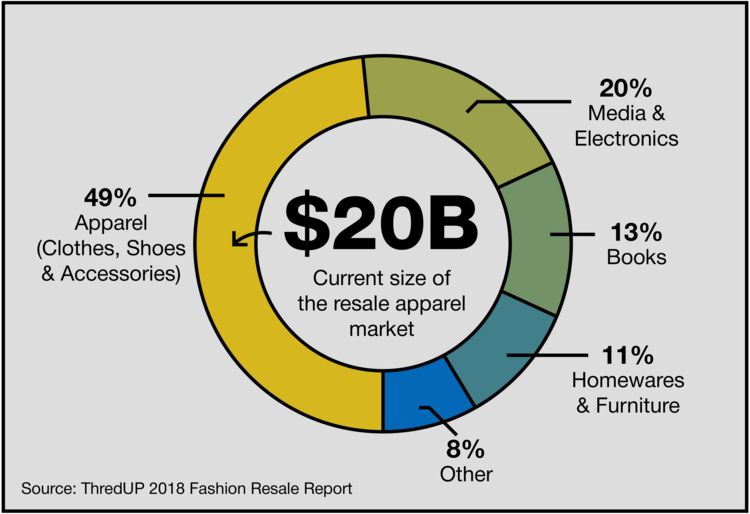

In general, reports about the resale industry will exclude pawn shops (because they make their money on loan interest paid) and stores that sell used vehicles, boats, trailers, and mobile homes. Some reports also exclude online resalers from their data. But for THIS post, I want to focus specifically on the online and offline fashion resale industry (including accessories).

Still, it’s worth noting that the resale of furniture and books are top performers as well. In fact, used furniture is one of the fastest-growing segments in the resale industry.

Let’s start with some big takeaways.

- Recommerce as an industry is expected to double in size over the next 5 years.

- Frugal, value-conscious Millennials are actively erasing the stigma formerly associated with resale.

- Resale enables consumers to upgrade the quality of their wardrobe for the same amount of money they would pay for fast fashion and off-priced / closeout apparel.

- The circular fashion movement and the uptick in resale are fueled, at least in part, by the desire for more sustainability and consumer mindfulness .

Market Size/ Growth

Let’s start with the big one – does this category make money? The answer is a resounding, “Uhhhh… Yeah.”

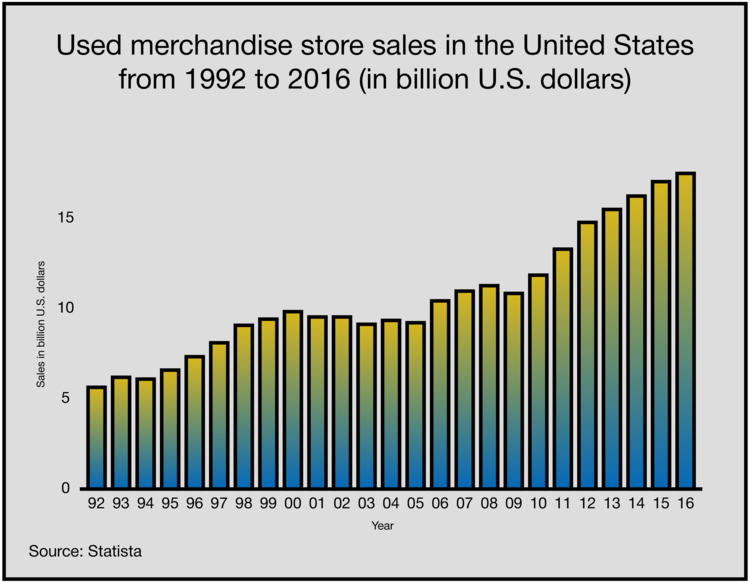

According to First Research, there are around 20,000 used merchandise stores generating $17.5 billion in annual sales in communities across the U.S.

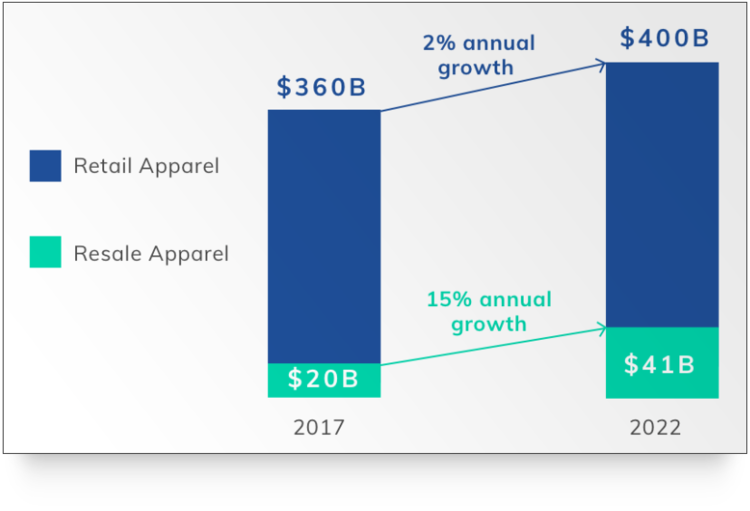

Here’s where things get exciting – ThredUP reports the online and offline resale industry is worth $20 billion, and expected to double in size to $41 billion by 2022, fueled in large part by the younger shoppers who have taken up the habit of thrifting. Resale apparel represents 49 percent of that number.

And there are now more physical thrift shops than ever before. According to Ibis World, the geographical spread of thrift stores mirrors the spread of the population. So, for the 25.7 percent of the population living in the Southeast region of the U.S., they are living in a region that accounts for 27.8 percent of resale industry establishments

There are also more thrifters than ever before. Post-Great Recession, resale revenue increased more than 50 percent (from 2008 to 2016). Coincident with that increase, department store sales declined by about 25 percent.

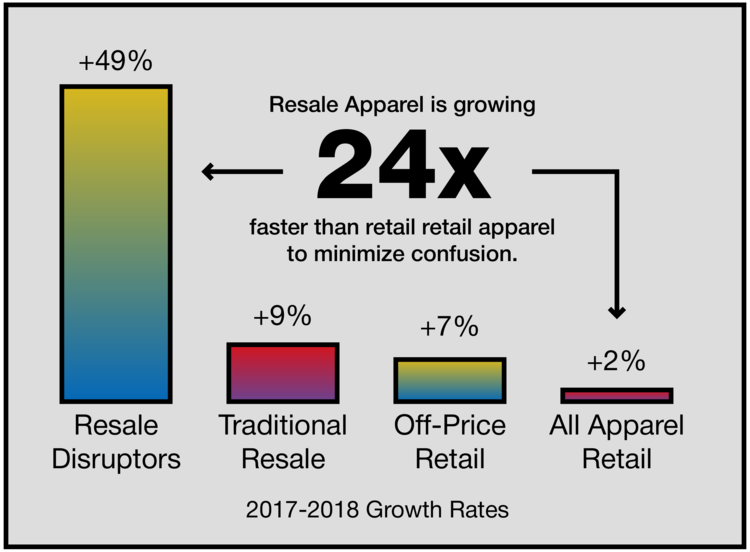

Whether the economy is up or down, resale store sales are consistently increasing, and the growing popularity of online resale marketplaces such as ThredUP, Poshmark, The RealReal, and Depop is enabling resale to grow more than 20 times faster than retail. 20 times!

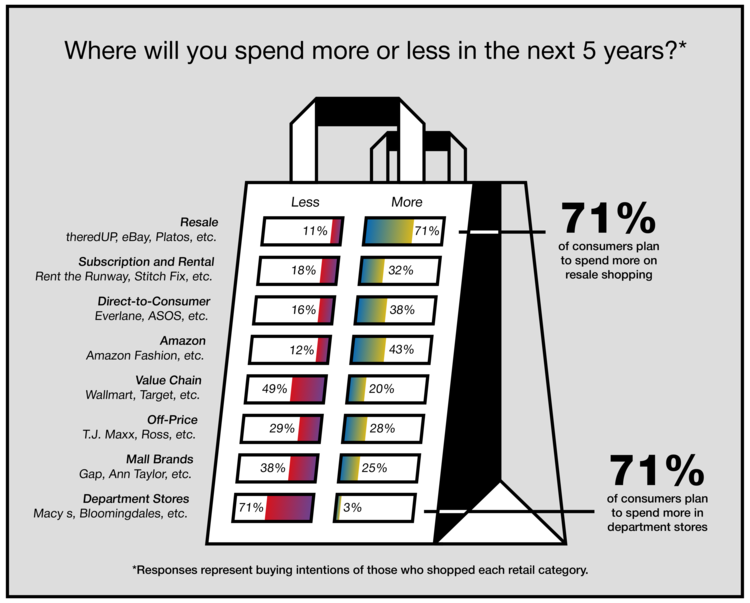

Younger thrifters are redirecting their apparel spending from off-price stores like TJ Maxx and Burlington to thrift stores. ThredUP’s 2016 Fashion Resale Report said 87 percent of thrifters had redirected a portion of their spending from off-price retailers the ones I mentioned to online and offline resale shops.

According to America’s Research Group, 16 – 18 percent of Americans will shop at a thrift store during a given year. To put this in perspective, 12 – 15 percent will shop at consignment resale shops, 11.4 percent will shop in a factory outlet mall, 19.6 percent will hit the regular apparel stores, and 21.3 percent will shop at a major department store.

Don’t expect to see any signs of slowing down, either. In the five-year period from 2017 to 2022, retail apparel is expected to experience annual growth of two percent, growing from $360 billion to $400 billion. On the flip side, the resale apparel is expected to grow from $20 billion to $41 billion, at a rate of 15 percent annually.

According to ThredUP, one in three women shopped secondhand last year. ThredUP also points out that 70 percent of its first-time customers are also first-time resale shoppers, which means the resale sector is consistently producing new customers, online and offline.

In 2012, 11 percent of the items in a thrifter’s closet were secondhand. By 2017, nearly 25 percent of the items in a thrifter’s closet were secondhand. By 2022, that number could reach as high as 40 percent.